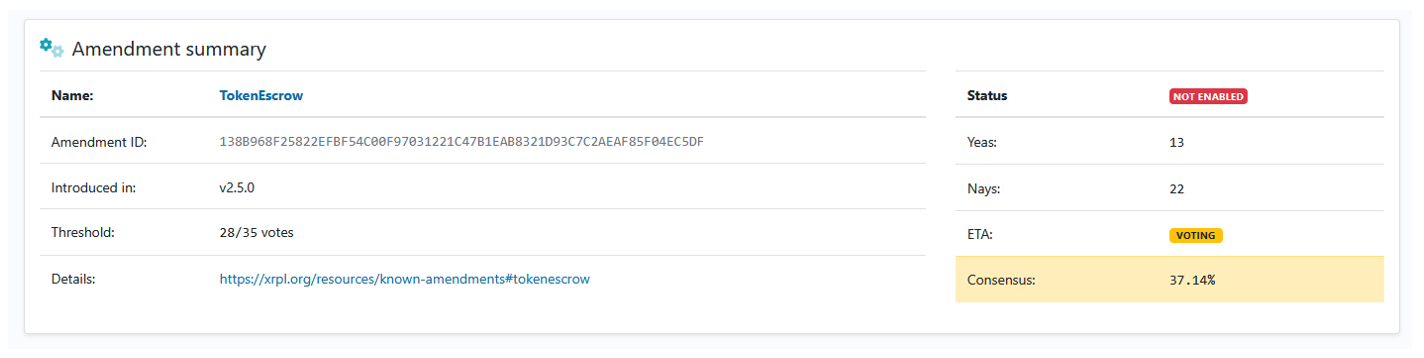

This is the second in a series of articles devoted to the new amendments introduced for consensus voting with the latest version of the XRP Ledger (v2.5.0).

The first article in the series introduced and explained the amendment system. This article is about the TokenEscrow amendment (XLS-85) and assumes the reader is reading the series in order. If needed, please refer back to the first article for a baseline understanding of the process.

Thanks for reading TEUCRIUM! Subscribe for free to receive new posts and support my work.

The Current Escrow

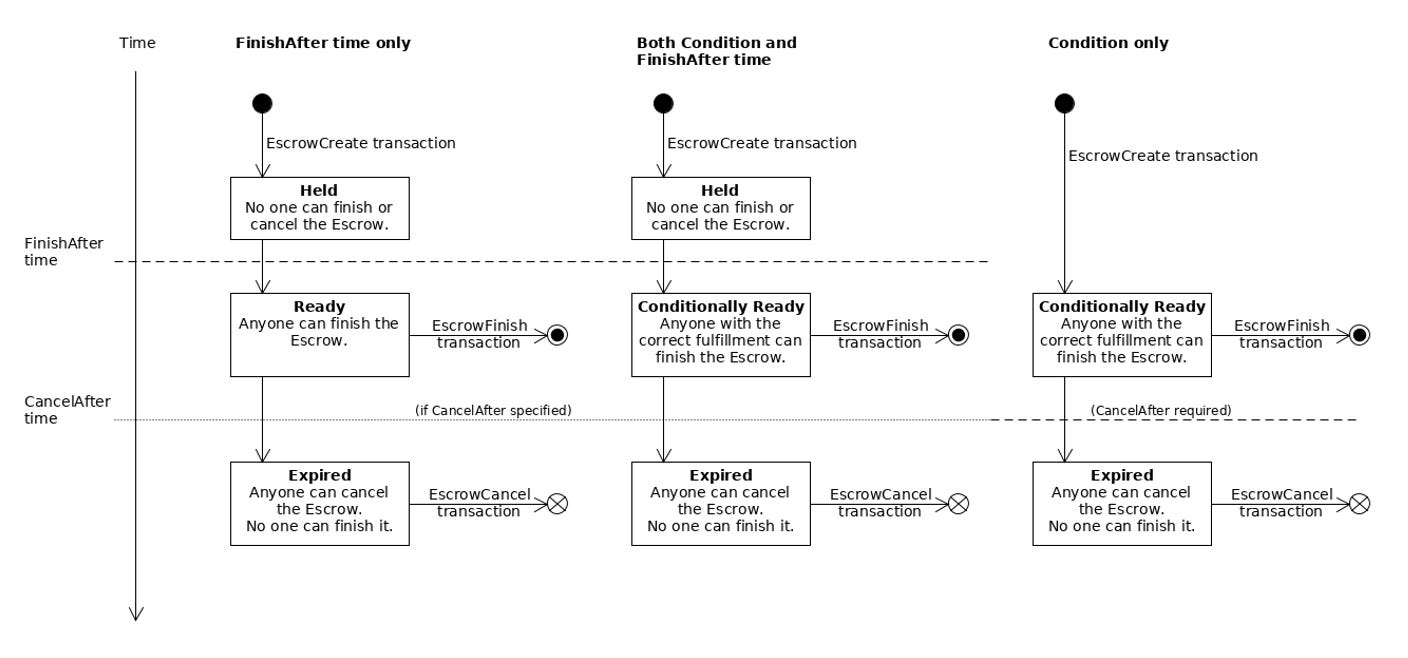

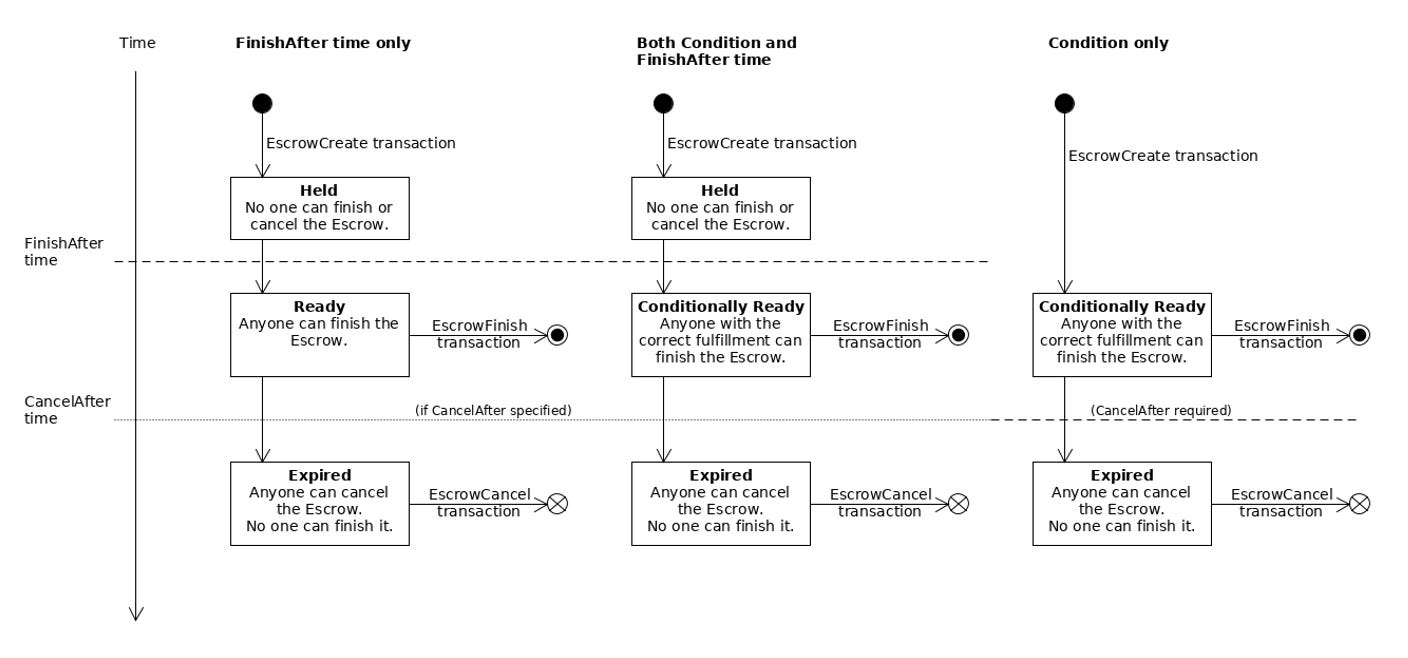

Before diving directly into the new amendment, we need to take a look at the current escrow functionality. Escrow was added in the Escrow amendment proposed in the v0.60.0 version update of ripple.1 Once approved, this escrow system added EscrowCreate, EscrowFinish, and EscrowCancel along with an Escrow ledger object type to the system. It also allowed for time-based usage, cancellations, and flexible control of execution for settlement by either sender or recipient. This was a powerful addition to the architecture of the network as it allowed locked contracts to function in a seamless way.

Here's a basic example of Escrow usage.

Person A (Sender) wants to send 1 XRP to Person B (Recipient) and the sender wants a 2-day delay before the XRP can be claimed. Additionally, if the recipient doesn’t claim the XRP within 2 days after that, the escrow expires.

The sender sends an EscrowCreate transaction with those specifications, the XRP is taken from their account, and an Escrow object is created on the XRP Ledger. That XRP remains locked up for 2 days. No one can access it at all. The recipient can see the pending transaction but can’t access it. After the stated time has elapsed, an EscrowFinish transaction can be sent to release the XRP to the recipient.

It’s important to note that anyone can send the EscrowFinish transaction but the person sending it pays the transaction fee. If no one sends that transaction within 2 more days, the EscrowCreate expires and the XRP reverts to the original account. While this is a simple use case, there are plenty of conditionals that can be set for more complex usage. There is one major drawback to this function. It is limited to use with XRP only. No other digital assets can be stored in escrow, limiting its scope. Additionally, there is no way to synchronize execution across multiple conditional dependencies in an automated way.

TokenEscrow (XLS-85)

The new TokenEscrow amendment reshapes the use case for Escrow and opens the scope dramatically. It enables escrows for all types of tokens.2 This means you can take any digital asset, so long as the issuer approves, and use it as part of an Escrow transaction.

The institutional appetite for this functionality is obvious. Banks and corporations routinely have to deal with regulated digital assets like stablecoins. These represent real-world currencies in digital form. These organizations need escrow capabilities that work across all assets, not just XRP. TokenEscrow removes this barrier by allowing any approved digital asset to be locked in escrow, making the XRP Ledger suitable for standard financial operations.

Multi-purpose tokens (MPT), also added with TokenEscrow, bring more complexity to the ecosystem.4 MPTs can represent anything from airline miles to private equity stakes. With this update they can be placed in escrow just like XRP can right now. This opens doors for businesses to automate complex financial agreements without having to rely on traditional intermediaries.

From a technical standpoint, TokenEscrow maintains the security and reliability that has made the original escrow system so trustworthy. The amendment respects issuer permissions, meaning token creators retain control if their assets can be used or not. This permission structure allows use in regulated environments where compliance requirements are tight. It also preserves the ledger's integrity by verifying that all token rules and restrictions are applied even when assets are in escrow.5

The amendment lets participants build settlement systems that involve multiple steps and multiple parties. Instead of needing to manually coordinate separate transactions, participants can implement automated sequences where one escrow release triggers the next. This reduces the risk of incomplete settlements and removes the need for third party supervision of complex deals.

Let’s look at a simple example of how TokenEscrow would enable an international transaction. These transactions often involve multiple currencies and complex timing requirements so handling them with coordinated escrows would be a great use case.

A U.S. company wants to buy goods from Japan. They escrow USD-backed stablecoins, like RLUSD, while the Japanese seller escrows shipping documentation as digital tokens. Once the conditions of the escrows are met, most likely when the shipping documentation is verified, both escrows would be released.

This seems simple enough but what if the buyer wanted to stagger payments in three steps, a RLUSD deposit to be released with confirmation of shipping, a further XRP amount to be released when the goods are verified at customs, and a final payment in RLUSD once the goods are delivered on site. TokenEscrow allows this waterfall of payment execution structure along with cross-currency usage.

TokenEscrow, if approved, would help to reduce overall counterparty risk across the digital landscape while bringing in more institutional participants. The next amendment we’ll discuss is Batch Amendment (XLS-56) which brings better execution to XRPL.

1 XRPL.org. "Known Amendments." Accessed August 6, 2025. https://xrpl.org/resources/known-amendments#escrow.

2 Angell, Denis. "XLS-85d: Token Escrow — Token-Enabled Escrows." GitHub Discussion #248. XRPL-Standards repository, February 26, 2025. https://github.com/XRPLF/XRPL-Standards/discussions/248.

3 XRPL.org. "Introducing XRP Ledger version 2.5.0." June 17, 2025. https://xrpl.org/blog/2025/rippled-2.5.0.

4 XRPLF. "MPT (MPTokens) FAQ." GitHub Wiki. Last modified May 15, 2025. https://github.com/XRPLF/rippled/wiki/MPT-(MPTokens)-FAQ.

5 CoinCentral. "XRP Ledger 2.5.0 Launch Adds Token Escrow and DEX Permissions." June 25, 2025. https://coincentral.com/xrp-ledger-2-5-0-launch-adds-token-escrow-and-dex-permissions/.

The information provided on this page and its associated documents is intended to provide a broad overview for discussion purposes. It is subject to change and should not be taken as financial or investment advice. Teucrium Trading LLC and Teucrium Investment Advisors, LLC make no offers to sell, solicitations to buy, or recommendations for any security, nor do they offer advisory services.

Past performance is not indicative of future results. Teucrium disclaims any liability for any actions taken based on the information provided herein.

Thanks for reading TEUCRIUM! Subscribe for free to receive new posts and support my work.