Corn

Corn futures attempted an early-week rally but faltered after May’25 futures struggled to hold levels above $4.70. Prices retreated amid profit-taking following a muted March crop report, which offered little excitement for traders. The WASDE report provided minimal adjustments, keeping U.S. corn stocks largely unchanged and leaving traders without significant new catalysts.

Market sentiment remains cautious amid tariff uncertainty, with President Trump extending the tariff delay for Mexico and Canada into early April. Any further announcements from Washington could spark volatility, keeping the market sensitive to policy developments.

In South America, the Brazilian first corn harvest has surpassed the halfway mark, while second-crop (safrinha) planting has reached 92%. Private estimates in Brazil indicate steady to slightly increased production, adding pressure to global supply expectations. Conversely, Argentina faces reduced production forecasts despite recent rains, as earlier dry conditions may have caused irreversible damage. Argentina’s corn harvest currently stands at 8% completed.

Technically, corn prices closed just above the 200-day moving average. A breakdown below this level suggests a possible test of recent lows near $4.42½, where we expect support extending toward $4.30. We see resistance between $4.70 and the 20-day moving average near the 50% Fibonacci retracement level.

Key Levels: We see resistance at $4.70–$4.85. We expect support at $4.42½–$4.30.

Soybeans

Soybean futures traded unevenly through the week, initially pressured lower before finding stability. The market remains vulnerable to U.S.-China trade developments, with persistent uncertainty over tariffs keeping buyers cautious.

The latest USDA report offered few surprises domestically, leaving soybean stocks mostly unchanged. Market participants continue closely monitoring potential adjustments to export estimates given the tariff impact and slowing demand. Rumors of a U.S.-China trade summit later this summer could offer some optimism, although months of trade uncertainty still lie ahead.

In Brazil, harvest progress reached 61%, supported by generally favorable weather conditions. Argentine production forecasts remain subdued despite late-season rainfall, as private estimates suggest a significant shortfall compared to USDA figures.

We see technical resistance between $10.25 and $10.50, aligning closely with the 50% retracement and key moving averages. We expect support near $10.00, with further downside risk toward $9.50.

Wheat

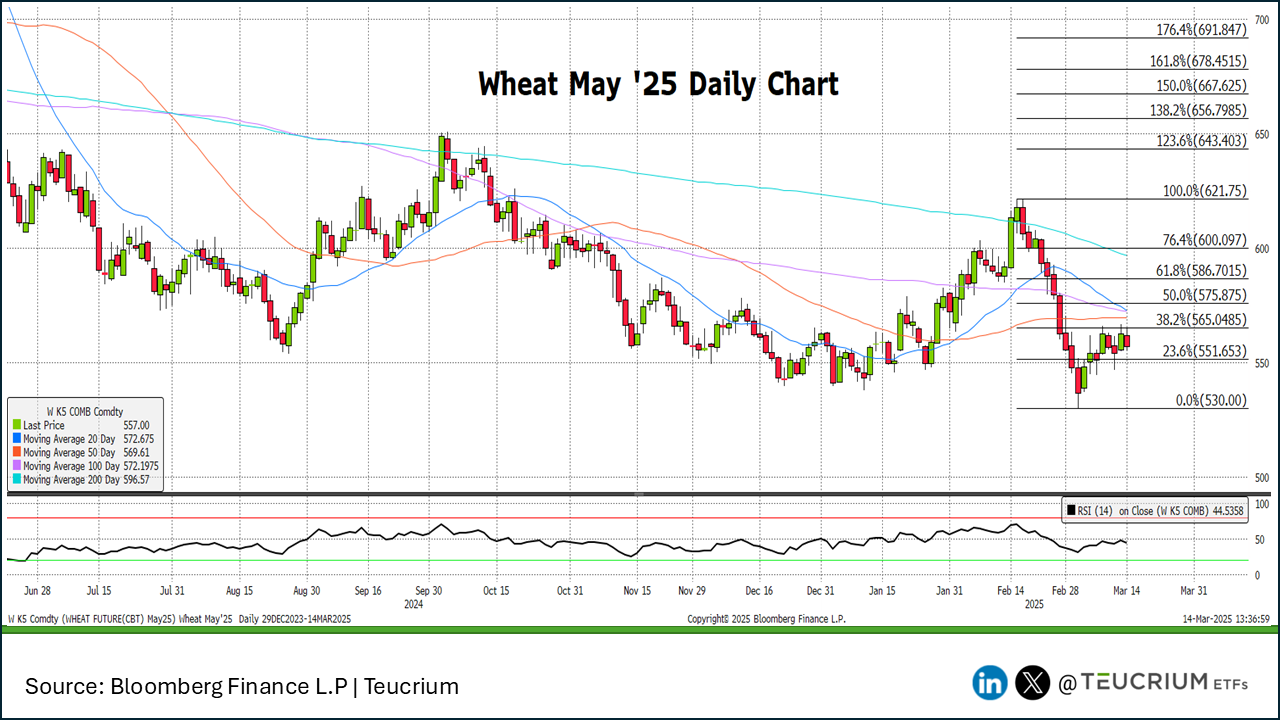

Wheat futures closed marginally higher on the week, displaying notable resilience despite an increase in global and domestic stock estimates in the latest USDA report.

Demand for U.S. wheat has strengthened modestly, partly driven by tightening Black Sea supplies as Russia limits exports to control domestic prices. Private forecasts further reduced Russian production estimates, which could offer underlying support to global prices.

However, Canada's recent report indicated higher-than-expected acreage, adding bearish pressure. With wheat prices hovering at neutral levels, the market is susceptible to downside moves, especially if fundamentals weaken further.

Technically, we expect nearby support around contract lows at $5.30, extending down toward $5.00. We see upside resistance near recent highs around $5.70, with limited bullish momentum absent significant news.

Key Levels: We see resistance at $5.50–$5.70. We expect support at $5.30–$5.00.

Sugar

Sugar futures rallied strongly, recovering from recent lows as traders booked profits and technical support held firm at the 50% retracement and 50-day moving average. Prices gained nearly 95 ticks on bullish late-week developments, including a weaker U.S. dollar and revised production estimates from the International Sugar Organization projecting a deeper global deficit.

Despite persistent uncertainty related to tariffs and broader commodity caution, sugar managed to maintain upward momentum. Concerns over dryness impacting global sugar production provided additional bullish fuel.

Looking forward, we see key resistance levels at $0.1950–$0.2000. We expect support has adjusted higher and now sits near $0.1850, providing a near-term floor should prices retreat.

Technical traders remain vigilant, awaiting fresh fundamental news before committing further.

Key Levels: We see resistance at $0.1950–$0.2000. We expect support at $0.1875–$0.1850.